Buy Real bank Account

Are you tired of complicated processes and endless paperwork just to open a Buy Real bank Account? You’re not alone.Having a real bank account is essential for managing your money safely and easily. But what exactly makes a bank account “real,” and how can you get one without the hassle? You’ll discover simple steps and insider tips that will help you open your own real bank account quickly.Keep reading, because the right account can change the way you handle your finances—and it’s easier than you think.

Types Of Bank Accounts

Understanding the types of Buy Real bank Account helps manage money better. Banks offer different accounts for various needs. Each account has unique features and benefits. Choosing the right one saves time and money.

Savings Account

A savings Buy Real bank Account is for storing money safely and earning interest. It encourages saving habits with easy access to funds.

- Earns interest on the balance

- Limited withdrawals per month

- Ideal for emergency funds or short-term savings

Current Account

Current accounts suit businesses and frequent transactions. They offer unlimited withdrawals and deposits.

- No interest earned on balance

- Allows overdraft facility in some banks

- Best for daily financial activities and payments

Fixed Deposit Account

A fixed deposit account locks money for a fixed time at a higher interest rate.

- Term ranges from months to years

- Higher interest than savings accounts

- Penalty for early withdrawal

Recurring Deposit Account

Recurring deposits help save small amounts regularly. The bank pays interest on the total saved.

- Fixed monthly deposits

- Fixed tenure with guaranteed returns

- Good for disciplined saving

Benefits Of A Real Bank Account

A Buy Real bank Account offers many benefits that help manage money safely and easily. It provides a secure place to keep your money. Also, it helps with daily transactions like paying bills, receiving salary, and saving for future needs. Having a real bank account makes money management clear and organized.

Secure Storage Of Money

A Buy Real bank Account keeps your money safe from theft and loss. Banks use strong security systems to protect your funds. Unlike cash, money in a Buy Real bank Account cannot be lost or stolen easily.

Easy Access To Funds

You can access your money anytime through ATMs, online banking, or mobile apps. This convenience saves time and effort. It also allows you to pay bills or shop without carrying cash.

Helps Build Financial History

Buy Real bank Account create a record of your financial activity. This history helps you apply for loans or credit cards. It shows banks you can manage money responsibly.

Earns Interest On Savings

Many Buy Real bank Account offer interest on the money saved. This means your money grows over time without extra work. The interest rate varies but adds value to your savings.

Facilitates Easy Payments And Transfers

- Send money to family or friends quickly

- Pay utility bills without queues

- Receive salary directly from employers

Supports Budgeting And Money Management

Bank statements help track income and expenses. This makes budgeting simple and clear. You can plan your spending and avoid unnecessary debt.

How To Open A Bank Account

Opening a Buy Real bank Account is the first step to managing money safely and easily. A real bank account helps you save money, receive payments, and pay bills. The process is simple and takes little time. This guide explains how to open a Buy Real bank Account with clear steps and tips.

Choose The Right Bank And Account Type

Start by selecting a bank that fits your needs. Think about services, fees, and convenience.

- Savings Account: Good for saving money with interest.

- Checking Account: Best for daily transactions and bill payments.

- Online Bank: Offers easy access via mobile or computer.

Compare banks and account types to find the best option.

Prepare The Required Documents

Banks need documents to confirm your identity and address. Get these ready:

| Document Type | Examples |

|---|---|

| Proof of Identity | Passport, National ID, Driver’s License |

| Proof of Address | Utility Bill, Rental Agreement, Bank Statement |

| Other Documents | Social Security Number, Employment Proof (if required) |

Visit The Bank Or Apply Online

Decide how to apply. Visit the bank branch or use the bank’s website.

- Fill out the application form with personal details.

- Submit all required documents.

- Provide a deposit if the account needs one.

Online applications are faster, but in-person help is available at branches.

Verify Your Identity And Sign The Agreement

The bank will check your documents and ask you to sign a contract.

This step confirms your information and agreement to bank rules.

Keep a copy of the signed agreement for your records.

Activate Your Account And Start Using It

Once approved, you will receive your account details.

- Get your debit card and PIN.

- Set up online banking access.

- Make your first deposit if needed.

Your bank account is ready for use. Manage your money safely and easily.

Documents Required

Opening a Buy Real bank Account requires submitting certain documents to verify your identity and address. These documents ensure the bank meets legal rules and protects your money. Knowing which papers to prepare saves time and helps the process go smoothly.

Valid Identification Proof

Identification proof confirms who you are. Banks need this to verify your identity and avoid fraud.

- Passport

- Driver’s license

- Government-issued ID card

- Aadhar card (for India)

Address Proof

Address proof shows where you live. It helps banks send statements and important information.

- Utility bill (electricity, water, gas) not older than 3 months

- Rental agreement

- Bank statement with address

- Property tax receipt

Income Proof

Income proof is needed for some account types. It shows your ability to maintain the account.

- Salary slips for the last 3 months

- Income tax returns

- Bank statements showing salary credits

- Business registration certificate (for self-employed)

Additional Documents For Special Accounts

Some accounts need extra papers depending on their purpose or type.

| Account Type | Additional Documents |

|---|---|

| Minor Account | Birth certificate, Guardian’s ID and address proof |

| Senior Citizen Account | Age proof like passport or senior citizen ID card |

| Business Account | Business license, partnership deed, or company registration |

Difference Between Savings And Current Accounts

Understanding the difference between savings and current accounts is important before opening a Buy Real bank Account. Both accounts serve different purposes and offer unique features. Choosing the right one depends on how you plan to use the account.

Savings Account: Purpose And Features

A Buy Real bank Account is designed for individuals who want to save money safely. It helps you grow your money with interest. The main goal is to encourage saving.

- Earns interest on the balance

- Limited number of withdrawals per month

- Ideal for personal savings

- Usually has a low minimum balance requirement

Current Account: Purpose And Features

A Buy Real bank Account suits businesses or people who need frequent transactions. It allows unlimited deposits and withdrawals. This account does not earn interest.

- No interest earned on balance

- Unlimited transactions allowed

- Used for daily business operations

- May require a higher minimum balance

Key Differences Between Savings And Current Accounts

| Feature | Savings Account | Current Account |

|---|---|---|

| Purpose | Saving money and earning interest | Frequent transactions and business use |

| Interest | Earns interest | No interest |

| Transaction Limit | Limited monthly withdrawals | Unlimited transactions |

| Minimum Balance | Usually low | Often higher |

| Best For | Individuals saving money | Businesses and traders |

Online Vs Traditional Buy Real bank Account

Choosing between an online Buy Real bank Account and a traditional bank account affects how you manage money daily. Both types offer unique features, benefits, and challenges. Understanding their differences helps pick the best fit for your needs. Below, we explore key points to compare online and traditional bank accounts.

What Is An Online Bank Account?

Buy Real bank Account operate entirely through the internet. You open, manage, and use the account via websites or mobile apps. These banks usually have no physical branches. They focus on convenience and often offer higher interest rates due to lower costs.

- Access accounts anytime, anywhere with internet

- Lower fees or no monthly fees

- Faster account setup and transactions

- Less face-to-face support

What Is A Traditional Bank Account?

Traditional Buy Real bank Account come from banks with physical branches. Customers visit branches for services like deposits, withdrawals, and consultations. These banks offer personal help and a wide range of financial products.

- In-person support and advice

- Access to physical branches and ATMs

- More fees due to branch maintenance

- Longer processing times for some services

Comparison Table: Online Vs Traditional Bank Accounts

| Feature | Online Bank Account | Traditional Bank Account |

|---|---|---|

| Access | 24/7 via web or app | Branch hours and ATMs |

| Fees | Usually low or none | Monthly fees common |

| Interest Rates | Often higher | Usually lower |

| Customer Service | Online chat, email, phone | In-person and phone |

| Security | Strong online protection | Physical and digital security |

| Convenience | Highly convenient, no travel | Requires branch visits |

Advantages Of Online Buy Real bank Account

- Lower costs: No branch fees reduce expenses.

- Better interest: Higher savings rates common.

- Quick setup: Account opens fast, no paperwork.

- 24/7 access: Manage money anytime on devices.

Advantages Of Traditional Buy Real bank Account

- Personal help: Face-to-face support available.

- Wide services: Loans, safe deposit boxes, and more.

- Cash deposits: Easy at branches or ATMs.

- Trust factor: Long-standing reputation builds confidence.

Security Features In Bank Accounts

Security is the heart of every Buy Real bank Account. Protecting your money and personal data matters most. Banks use many safety measures to keep your account safe from theft and fraud. Understanding these security features helps you feel confident and secure.

Two-factor Authentication (2fa)

Two-factor authentication adds an extra layer of security. It asks for two types of identity checks before allowing access.

- First, you enter your password.

- Then, you confirm your identity with a code sent to your phone or email.

This process makes it harder for thieves to enter your account.

Encryption Technology

Banks use encryption to protect your data during online transactions. Encryption changes your information into a secret code.Only the bank’s system can read this code, keeping hackers away.This technology works quietly behind the scenes to keep your details safe.

Fraud Detection Systems

Fraud detection systems monitor your account activity. They look for unusual patterns or transactions.

For example:

- Large transfers

- Login from a new device or location

- Repeated failed login attempts

If anything looks suspicious, the bank alerts you or freezes the account temporarily.

Secure Login Methods

Banks use different login methods to protect your account:

- Strong Passwords: Must include letters, numbers, and symbols.

- Biometric Login: Use fingerprints or face recognition.

- Security Questions: Personal questions only you know.

These methods make it difficult for unauthorized users to access your account.

Account Alerts And Notifications

Many banks offer real-time alerts for account activities. You receive messages for:

- Withdrawals

- Deposits

- Login attempts

This helps you spot any strange activity quickly.

| Security Feature | Purpose | Benefit |

|---|---|---|

| Two-Factor Authentication | Verify identity with two steps | Stops unauthorized access |

| Encryption Technology | Protect data in transit | Keeps information secret |

| Fraud Detection | Monitor unusual activity | Prevents theft or fraud |

| Secure Login Methods | Confirm user identity | Blocks fake login attempts |

| Account Alerts | Notify about transactions | Enables quick response |

Account Maintenance Fees

Buy Real bank Account maintenance fees are charges banks apply to keep your account active. These fees cover the cost of managing your account, including customer service, statements, and transactions. Understanding these fees helps you avoid surprises and manage your money better.

What Are Account Maintenance Fees?

Account maintenance fees are monthly or yearly charges for holding a Buy Real bank Account. These fees can vary by bank and account type. Some banks charge a flat fee, while others have tiered fees based on your account activity.Not all accounts have these fees. Some banks offer accounts without maintenance fees if you meet certain rules. These rules might include:

- Maintaining a minimum balance

- Setting up direct deposit

- Making a certain number of transactions

How To Avoid Account Maintenance Fees

You can avoid these fees by following simple steps. Many banks waive fees if you meet certain conditions.

- Keep a minimum balance: Maintain the required amount in your account.

- Set up direct deposit: Have your paycheck or benefits sent directly to your account.

- Use online banking: Some banks waive fees for customers who use online services.

- Link accounts: Combining accounts at the same bank may reduce fees.

Typical Account Maintenance Fee Charges

| Bank Type | Fee Amount | Conditions to Waive Fee |

|---|---|---|

| Traditional Banks | $5 – $15 per month | Minimum balance or direct deposit |

| Online Banks | Usually $0 – $5 per month | Online activity or balance requirements |

| Credit Unions | Often $0 – $10 per month | Membership and balance rules |

Why Account Maintenance Fees Matter

These fees affect your savings. Small monthly fees add up over time.Knowing about fees helps you choose the right account. It also helps you plan your finances better.

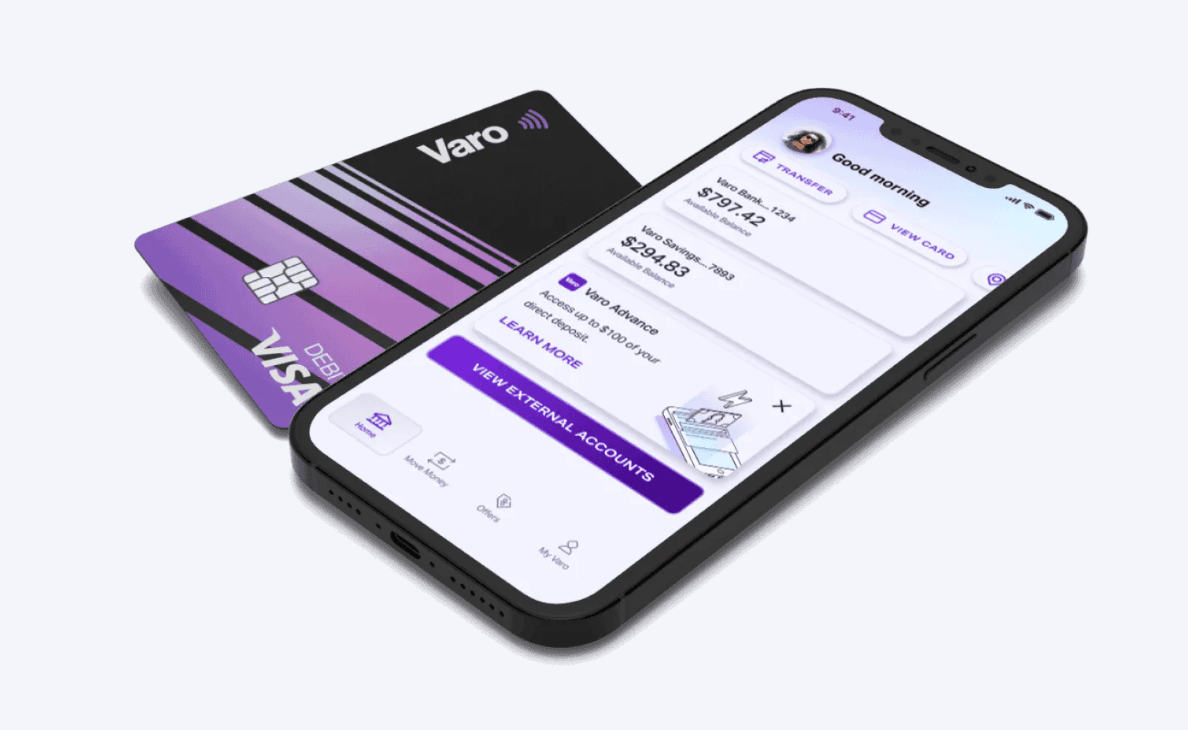

Using Mobile Banking Services

Mobile banking services have changed how people use their Buy Real bank Account. These services allow easy access to Buy Real bank Account anytime and anywhere. Managing money is simpler with just a smartphone. Many tasks that needed a visit to the bank can now be done online quickly and safely.

What You Can Do With Mobile Banking

Mobile banking offers many useful features for Buy Real bank Account holders. Here are some common actions you can perform:

- Check account balance and recent transactions instantly.

- Transfer money between your accounts or to others.

- Pay bills such as utilities, credit cards, and loans.

- Deposit checks by taking photos with your phone.

- Set up alerts for low balance or suspicious activity.

How To Keep Your Mobile Banking Secure

Security is key when using mobile banking with your Buy Real bank Account. Follow these tips to protect your money and data:

- Use strong passwords with letters, numbers, and symbols.

- Enable two-factor authentication if the app offers it.

- Do not share login details with anyone.

- Keep your phone’s software updated for the latest security fixes.

- Log out after each session to prevent unauthorized access.

Benefits Of Using Mobile Banking With A Real Bank Account

| Benefit | Description |

|---|---|

| Convenience | Access account anytime without visiting a branch. |

| Speed | Complete transactions in seconds with a few taps. |

| Control | Monitor spending and manage money easily. |

| Cost-effective | Save on travel and banking fees. |

| Real-time updates | Receive instant notifications about account activity. |

Tips For First-time Mobile Banking Users

Starting mobile banking with your Buy Real bank Account is simple. Follow these steps for a smooth experience:

- Download the official banking app from a trusted store.

- Create an account using your Real Bank Account details.

- Set up strong security options like PIN or fingerprint login.

- Explore the app’s features slowly to understand its functions.

- Contact customer service if any problem arises.

How Interest Is Calculated

Understanding how interest is calculated on a Buy Real bank Account helps you manage your money better. Interest is the extra money the bank pays you for keeping your funds in the account. It grows your balance over time without extra effort. Knowing the calculation methods can help you see how your savings increase.

Simple Interest Calculation

Simple interest is calculated only on the original amount you deposit. It does not include any interest already earned. The formula is easy:

Simple Interest = Principal × Rate × Time

- Principal: The initial amount of money deposited.

- Rate: The interest rate per year, shown as a decimal.

- Time: The number of years the money is kept in the account.

This method gives you a fixed amount of interest every year.

Compound Interest Calculation

Compound interest means the bank pays interest on both the original amount and the interest earned before. This helps your money grow faster. The formula is:

A = P (1 + r/n)^(nt)

- A: The total amount after interest.

- P: The principal or initial deposit.

- r: Annual interest rate (decimal).

- n: Number of times interest is compounded per year.

- t: Time in years.

Interest can be compounded yearly, monthly, or daily, increasing your earnings.

Comparison Table: Simple Vs Compound Interest

| Feature | Simple Interest | Compound Interest |

|---|---|---|

| Interest on | Principal only | Principal + Interest earned |

| Growth Rate | Linear | Exponential |

| Interest Formula | P × r × t | P (1 + r/n)^(nt) |

| Effect of Time | Less impact | More impact with longer time |

Common Bank Account Charges

Having a Buy Real bank Account means knowing about the charges banks may apply. These fees can affect your money and how you manage your account. Understanding common bank account charges helps you avoid surprises and plan your finances better.

Monthly Maintenance Fees

Many banks charge a monthly fee to keep your account active. This fee covers account services and upkeep. Some banks waive this fee if you keep a minimum balance or have regular deposits.

Atm Withdrawal Fees

Using ATMs outside your bank’s network can lead to extra charges. These fees vary by bank and ATM operator. Always check if your bank reimburses these fees or offers free ATM access.

Overdraft Charges

Spending more than your account balance causes an overdraft. Banks often charge a fee for this service. Overdraft fees can be high and add up quickly, so monitor your account closely.

Transaction Fees

Some Buy Real bank Account limit the number of free transactions. Exceeding this limit may result in fees for each extra transaction. These charges apply to withdrawals, transfers, or payments.

Paper Statement Fees

Receiving paper statements by mail sometimes costs extra. Many banks encourage electronic statements to avoid this fee. Opting for e-statements saves money and helps the environment.

| Charge Type | Description | Typical Fee Range |

|---|---|---|

| Monthly Maintenance | Fee for account upkeep | $5 – $15 |

| ATM Withdrawal | Fee for using non-network ATMs | $2 – $5 per transaction |

| Overdraft | Fee for spending more than balance | $25 – $35 per overdraft |

| Transaction | Fee for extra transactions beyond free limit | $0.50 – $1 per transaction |

| Paper Statement | Fee for mailed bank statements | $1 – $3 per statement |

Linking Bank Accounts With Other Services

Linking Buy Real bank Account with other services makes managing money easier and faster. It allows users to connect their Buy Real bank Account with apps and platforms they use every day. This connection helps with payments, tracking expenses, and more. Many people find it simple to use one account for multiple services. It saves time and reduces errors in transactions.

How To Link Your Real Bank Account

Connecting your Buy Real bank Account to other services is simple. Follow these steps:

- Log in to your Real Bank Account online or via the mobile app.

- Go to the settings or linked accounts section.

- Select the service you want to connect, like a payment app or budgeting tool.

- Enter your account details and authorize the connection.

- Confirm the link with any verification codes sent to your phone or email.

Most services use secure methods to keep your information safe during linking.

Popular Services To Link With Your Bank Account

| Service Type | Purpose | Example Services |

|---|---|---|

| Payment Apps | Send and receive money quickly | PayPal, Venmo, Google Pay |

| Budgeting Tools | Track spending and save money | Mint, YNAB, PocketGuard |

| Shopping Platforms | Make fast online purchases | Amazon, eBay, Walmart |

| Investment Apps | Manage investments and stocks | Robinhood, ETRADE, Acorns |

Benefits Of Linking Bank Accounts

- Convenience: Pay bills and transfer money with a few clicks.

- Better tracking: See all transactions in one place.

- Time-saving: Avoid entering bank details multiple times.

- Automatic updates: Apps update your balance and spending instantly.

- Improved budgeting: Get alerts and summaries to control spending.

Security Tips For Linking Accounts

- Use strong, unique passwords for all services.

- Enable two-factor authentication where possible.

- Link accounts only with trusted apps and websites.

- Regularly review linked services and remove those you no longer use.

- Keep your device’s software and apps updated to avoid vulnerabilities.

Bank Account For Minors

A Buy Real bank Account for minors is a special type of Buy Real bank Account designed for children and teenagers. It helps young people learn about saving money and managing their finances early. These accounts often require a parent or guardian to open and control them until the minor reaches a certain age.

What Is A Bank Account For Minors?

A Buy Real bank Account for minors is usually a joint account or a custodial Buy Real bank Account. It lets kids deposit money and keep it safe. Parents or guardians oversee the account and teach kids about money management. These accounts often have no monthly fees and low minimum balances.

Benefits Of A Minor’s Bank Account

- Teaches financial responsibility from a young age

- Encourages saving habits and goal setting

- Safe place to store money

- Easy access to funds with parental control

- Builds a credit history for the future

Types Of Bank Accounts For Minors

| Account Type | Description | Age Limit |

|---|---|---|

| Joint Account | Shared between minor and adult; adult manages it | Typically under 18 years |

| Custodial Account | Adult manages funds until child reaches legal age | Varies by state, usually 18 or 21 |

| Teen Checking Account | Allows limited spending with parental approval | Usually 13 to 17 years |

How To Open A Bank Account For Minors

- Choose a bank that offers minor accounts

- Gather necessary documents: ID, birth certificate, proof of address

- Visit the bank with the minor and parent/guardian

- Complete the application form together

- Deposit the minimum amount required

Important Tips For Managing A Minor’s Account

- Set clear rules about spending and saving

- Review account statements regularly

- Use the account to teach budgeting skills

- Encourage the minor to ask questions

- Gradually give more control as they grow older

Closing A Bank Account

Closing a buy Real bank Account is a simple task but requires careful steps. It means stopping all transactions and ending your relationship with the bank. People close accounts for many reasons, like switching banks or no longer needing the account. Doing it the right way helps avoid fees or problems later.

How To Close A Bank Account

Follow these easy steps to close your Buy Real bank Account:

- Check your balance: Make sure no money is left or transactions are pending.

- Transfer funds: Move your money to another account or withdraw it.

- Cancel automatic payments: Stop any scheduled payments linked to the account.

- Contact your bank: Visit a branch, call customer service, or use online banking.

- Submit a closure request: Fill out any forms or give written notice if required.

- Get confirmation: Ask for a letter or email proving the account is closed.

Important Things To Remember

- Keep the account open until all payments clear.

- Check for any final fees or charges.

- Destroy any debit cards or checks linked to the account.

- Update your payment info for bills or subscriptions.

- Monitor your statements after closing to catch any issues.

Common Reasons To Close A Bank Account

| Reason | Description |

|---|---|

| High Fees | Too many charges make the account costly to keep. |

| Better Interest Rates | Switching to a bank with higher savings returns. |

| Moving Locations | Changing cities or countries where the bank has no branches. |

| Consolidation | Closing extra accounts to simplify finances. |

Tips For Managing Your Bank Account

Managing a Buy Real bank Account well is key to keeping your money safe and growing it over time. Simple habits can help you avoid fees, track your spending, and save more. This section shares easy tips to make your Buy Real bank Account work better for you.

Keep Track Of Your Transactions

Check your Buy Real bank Account regularly to see all deposits and withdrawals. Use your bank’s app or website for quick updates. This helps catch mistakes or unauthorized charges fast.

- Review your statement every week.

- Set alerts for big transactions.

- Note down any fees or unusual activity.

Set A Budget And Stick To It

Plan how much money you spend and save each month. A budget stops overspending and helps you reach goals like buying a home or going on vacation.

- List your monthly income.

- Write down fixed expenses like rent and bills.

- Allocate money for food, transport, and fun.

- Save a part of your income first.

Avoid Unnecessary Fees

Many Buy Real bank Account charge fees for certain services. Learn what these fees are and try to avoid them.

| Fee Type | How to Avoid |

|---|---|

| Monthly Maintenance Fee | Keep minimum balance or choose a no-fee account |

| ATM Fees | Use your bank’s ATMs only |

| Overdraft Fees | Set up alerts and track your balance carefully |

Use Online Tools And Mobile Apps

Banks offer apps and online tools that make managing money easy. Use them to transfer funds, pay bills, or check your balance anytime.

- Enable notifications for spending updates.

- Use budgeting features to control expenses.

- Deposit checks using mobile deposit services.

Secure Your Account Information

Protect your Buy Real bank Account details to prevent fraud. Use strong passwords and never share your login info.

- Change passwords regularly.

- Enable two-factor authentication if available.

- Log out after using public computers.

Frequently Asked Questions

What Is A Real Bank Account?

A real Buy Real bank Account is an official Buy Real bank Account held at a bank for financial transactions.

How Do I Open A Real Bank Account?

Visit a bank branch or website, provide ID, proof of address, and fill out an application.

What Documents Are Needed For A Real Bank Account?

Usually, you need an ID card, proof of address, and sometimes proof of income.

Can I Open A Real Bank Account Online?

Yes, many banks offer online account opening with digital ID verification.

What Are The Benefits Of A Real Bank Account?

It helps save money securely, pay bills, receive salary, and make transactions easily.

How Much Money Do I Need To Open A Bank Account?

Some banks require no minimum deposit; others may ask for a small initial amount.

Is A Real Bank Account Safe For My Money?

Yes, banks use security measures and government insurance to protect your funds.

Can I Have Multiple Real Bank Accounts?

Yes, you can open several accounts in different banks or for different purposes.

How Long Does It Take To Open A Real Bank Account?

Opening can take from a few minutes online to a few days at a branch.

What Fees Are Associated With A Real Bank Account?

Fees may include monthly charges, ATM usage, or overdraft fees, depending on the bank.

Conclusion

Having a Buy Real bank Account makes handling money safe and simple. It helps you save, pay bills, and send money easily. Choosing the right bank and account type matters a lot. Keep your information secure and check your balance often.A Buy Real bank Account supports your daily money needs. Start with basic accounts and grow as you learn more. Banking can feel easy and helpful with the right steps. Your money stays protected and ready when you need it. Trust the process and take control of your finances today.

Reviews

There are no reviews yet.