Buy Verified Klarna Accounts

Are you looking to make your online shopping smoother and safer? Verified Klarna accounts could be exactly what you need. When you have a verified account, you unlock faster payments, extra security, and exclusive offers that can save you money. Imagine checking out with just a few clicks, knowing your details are protected and your purchases are backed by Klarna’s trusted system.

You’ll discover how to get your Klarna account verified, why it matters, and how it can change the way you shop online for the better. Keep reading to learn how to take control of your shopping experience today.

What Are Verified Klarna Accounts

Verified Klarna Accounts offer users a trusted way to shop and pay later. These accounts confirm your identity and financial details to provide a smooth shopping experience. Verification helps Klarna reduce fraud and increase security for both buyers and sellers.

What Does Verification Mean For Klarna Accounts?

Verification means Klarna checks your personal information. They confirm your name, address, and payment details. This step helps Klarna trust you as a user. It also allows access to more Klarna features.

How To Verify Your Klarna Account

- Sign up with your email and phone number.

- Submit a government ID like a passport or driver’s license.

- Provide a valid payment method such as a credit or debit card.

- Confirm your identity by verifying your phone number or email.

Benefits Of Having A Verified Klarna Account

- Higher purchase limits for shopping.

- Access to Klarna Pay Later and installment plans.

- Improved security and fraud protection.

- Faster checkout process on supported sites.

- Better customer support options.

Who Should Verify Their Klarna Account?

Anyone who wants to shop online safely and use Klarna’s full features should verify. It suits regular buyers and people who want to spread payments over time. Verification also helps sellers trust the buyer’s identity.

Credit: www.security.org

Benefits Of Verification

Verified Klarna accounts offer several important benefits. Verification adds a layer of trust and security to your shopping experience. It helps Klarna confirm your identity and protect your account from fraud. Verified accounts often enjoy better service and easier access to Klarna’s features. Below are key benefits of verifying your Klarna account.

Improved Account Security

Verification helps keep your account safe. It ensures only you can use your Klarna account. This reduces the risk of unauthorized purchases. Klarna uses your verified information to spot suspicious activity quickly.

Higher Spending Limits

Verified accounts usually have higher spending limits. Klarna can trust verified users more, so it allows bigger purchases or installments. This gives you more flexibility when buying.

Faster Checkout Process

Verification speeds up the checkout process. Klarna can approve your payment faster with your verified details. It means less waiting and fewer steps when you pay.

Access To Exclusive Offers

Some discounts and deals are only for verified Klarna users. Verification can unlock special promotions and exclusive offers. This helps you save money on your purchases.

Better Customer Support

Verified users often get priority support. Klarna can quickly verify your identity during help requests. This makes solving problems easier and faster.

Summary Of Benefits

| Benefit | Why It Matters |

|---|---|

| Improved Account Security | Protects your personal info and stops fraud |

| Higher Spending Limits | Allows bigger purchases and more payment options |

| Faster Checkout Process | Reduces wait time during payment |

| Access to Exclusive Offers | Gives special deals only for verified users |

| Better Customer Support | Ensures quicker and smoother help from Klarna |

Verification Requirements

Verified Klarna accounts help keep your payments safe and secure. Verification makes sure the person using Klarna is really you. This process protects you from fraud and lets you use Klarna’s services with confidence.

Personal Information Needed

To verify your Klarna account, you must provide some basic personal details. These include:

- Full name

- Date of birth

- Address

- Email address

- Phone number

This information helps Klarna confirm your identity and contact you if needed.

Identity Documents

Klarna requires a valid ID to verify your account. Acceptable documents include:

| Document Type | Details |

|---|---|

| Passport | Must be current and clear |

| Driver’s License | Photo and personal details must be visible |

| National ID Card | Should be valid and official |

Upload a clear photo or scan of the document. The image must show all corners and details.

Age Requirement

Klarna only approves accounts for users who are 18 years or older. This rule follows legal guidelines for financial services.

If the user is under 18, Klarna will not verify the account or allow transactions.

Credit Check Process

Klarna runs a soft credit check during verification. This check does not affect your credit score. It helps Klarna assess your payment risk.

Details checked include:

- Credit history

- Outstanding debts

- Payment reliability

Bank Account Or Card Verification

Sometimes, Klarna asks to verify your linked bank account or card. This step confirms you own the payment method. The process may involve:

- Small temporary charges

- Entering a verification code sent to your bank

Once verified, Klarna can process payments smoothly and securely.

Step-by-step Verification Process

Verifying your Klarna account is important for secure payments and smooth shopping. The step-by-step verification process helps Klarna confirm your identity quickly. This process protects your account from fraud and ensures you can use all Klarna features safely.

Creating Your Klarna Account

Start by signing up on Klarna’s website or app. Use a valid email address and phone number. Choose a strong password for your account. This step sets the foundation for the verification process.

Providing Personal Information

Klarna asks for personal details like full name, date of birth, and address. Enter accurate information matching your official documents. This helps Klarna verify your identity without issues.

Uploading Identification Documents

Upload a clear photo of an ID. Options include a passport, driver’s license, or national ID card. Make sure the document is not expired and all text is readable.

- Use good lighting and avoid glare.

- Capture the entire document in the photo.

- Check that the photo is in an accepted format (JPEG, PNG).

Verifying Phone Number

Klarna sends a code to your phone via SMS. Enter this code into the app or website. This step confirms your phone number is active and belongs to you.

Reviewing And Confirming Details

Double-check all entered information for accuracy. Confirm the details before submitting. Any mistakes can delay the verification process.

Waiting For Verification Approval

Klarna reviews your submitted data and documents. This process usually takes a few minutes but can take up to 24 hours. You will get a notification once your account is verified.

| Step | Action | Tip |

|---|---|---|

| 1 | Create Account | Use a valid email and phone number |

| 2 | Enter Personal Info | Match details with your ID |

| 3 | Upload ID Document | Ensure clear, readable photos |

| 4 | Verify Phone Number | Enter the SMS code quickly |

| 5 | Confirm Details | Double-check for errors |

| 6 | Wait for Approval | Check notifications regularly |

Common Verification Issues

Verified Klarna accounts help users shop with more trust and safety. Verification checks your identity and payment details. Sometimes, users face problems during this process. These verification issues can stop you from using Klarna smoothly. Knowing the common problems helps fix them fast and avoid delays.

Invalid Or Mismatched Personal Information

One common issue is entering wrong or different personal details. Your name, address, or date of birth must match official documents exactly. Small spelling mistakes or wrong numbers cause verification to fail.

- Double-check spelling of your full name.

- Use the same address as on your ID or bank records.

- Enter your date of birth correctly in the format Klarna asks.

Problems With Uploaded Documents

Klarna may ask for ID or proof of address. Uploaded files that are unclear or incomplete cause delays.

| Common Document Issues | Tips to Fix |

|---|---|

| Blurry or dark photos | Use good lighting and focus the camera clearly |

| Partial or cut-off documents | Make sure whole document edges are visible |

| Expired ID cards | Upload a current, valid identification document |

Technical Issues During Verification

Sometimes, technical errors happen during the verification step. These include website glitches or slow internet.

- Clear your browser cache and cookies before trying again.

- Use a different browser or device if problems continue.

- Ensure your internet connection is stable and fast.

Bank Or Payment Method Problems

Klarna checks linked bank accounts or cards for verification. Issues here can block the process.

- Make sure your bank details are correct and up to date.

- Your card must be valid and allow online payments.

- Some banks block transactions for security. Contact your bank if needed.

How Verification Affects Credit Limits

Verification of your Klarna account plays a key role in setting your credit limits. A verified account shows Klarna that you are a real and trustworthy customer. This trust can lead to higher credit limits, allowing more freedom in purchases. Unverified accounts often have lower limits to reduce risk.

What Does Verification Involve?

Verification means confirming your identity and financial details. Klarna may ask for:

- Valid ID (passport, driver’s license)

- Proof of address (utility bill, bank statement)

- Phone number and email confirmation

Completing these steps helps Klarna trust you more.

How Verification Influences Credit Limits

Verified accounts usually get higher credit limits. Klarna uses your verified data to check your creditworthiness. The clearer your financial picture, the more Klarna can safely lend.

Some benefits of verification include:

- Access to larger purchase amounts

- Improved payment options

- Fewer restrictions on transactions

Credit Limit Range For Verified Vs. Unverified Accounts

| Account Status | Typical Credit Limit | Transaction Flexibility |

|---|---|---|

| Verified Account | $500 – $3,000+ | High |

| Unverified Account | $100 – $500 | Low |

Steps To Verify Your Klarna Account

- Log in to your Klarna account.

- Go to the verification section.

- Upload required documents.

- Confirm your contact details.

- Wait for Klarna to approve your verification.

Verification usually takes a few minutes to a few hours.

Security Features Of Verified Accounts

Verified Klarna accounts offer more than just convenience. They come with strong security features to protect your personal and financial information. These features keep your transactions safe and reduce the risk of fraud. Understanding these security measures helps you trust and use Klarna with confidence.

Two-factor Authentication (2fa)

Two-Factor Authentication adds an extra layer of security during login. After entering your password, Klarna sends a code to your phone or email. You must enter this code to access your account.

- Prevents unauthorized access

- Requires something you know (password) and something you have (phone)

- Easy to enable and use

Encrypted Data Transmission

Klarna uses encryption to protect data sent between your device and its servers. This means hackers cannot read your information during transmission.

| Encryption Type | Purpose |

|---|---|

| SSL/TLS | Secure online connections and protect data |

| End-to-End Encryption | Protects sensitive payment details |

Account Activity Monitoring

Klarna constantly checks for unusual activity in your account. This helps detect fraud early and stops suspicious actions quickly.

- Monitors login locations and devices

- Flags sudden changes in spending patterns

- Alerts users of unusual activity

Secure Payment Methods

Verified Klarna accounts use secure payment methods that protect your card and bank information. Klarna never shares your full payment details with merchants.

- Tokenization replaces card data with a code

- Reduces risk of payment fraud

- Supports trusted payment partners

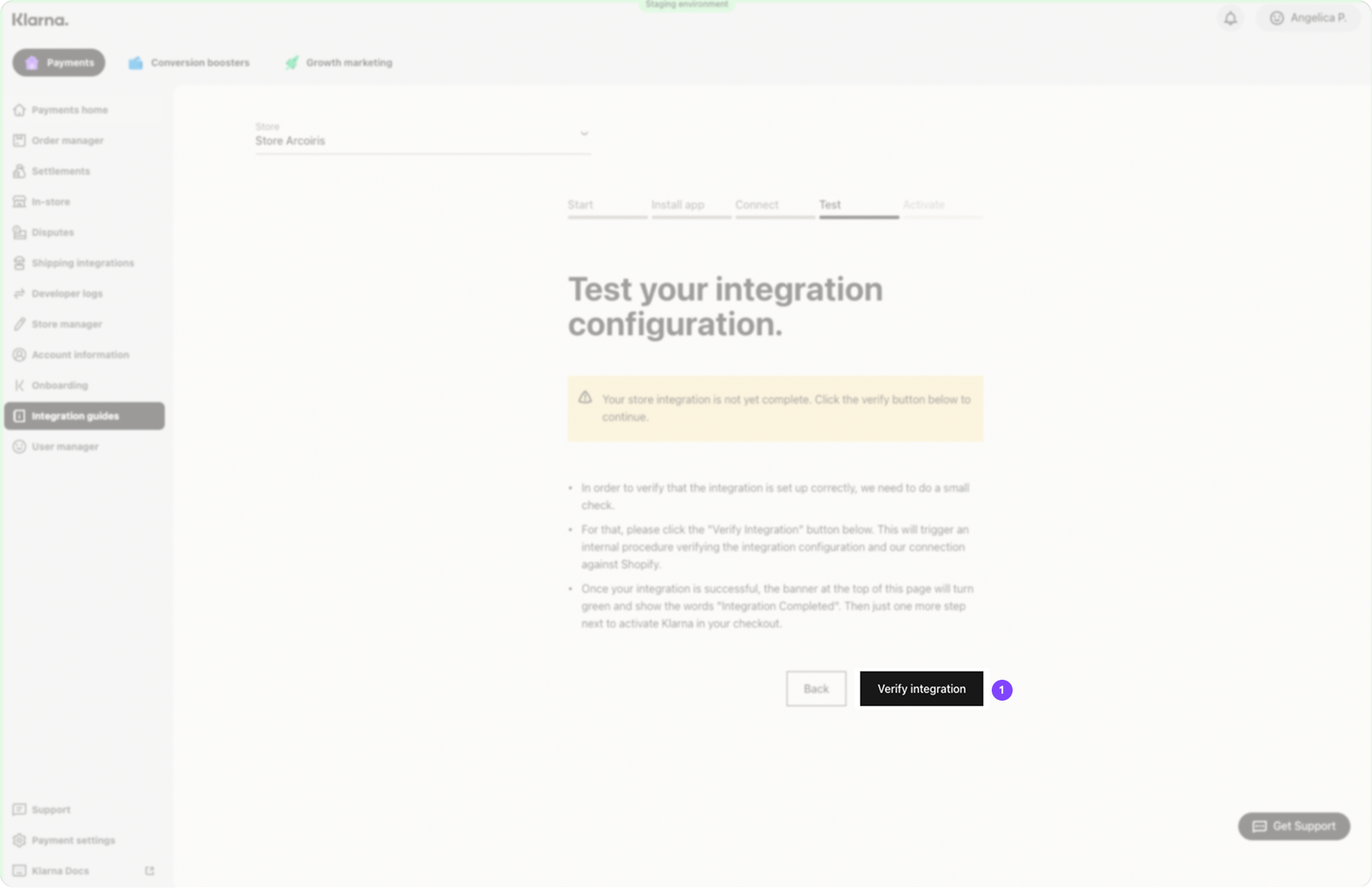

Credit: docs.klarna.com

Using Verified Accounts For Online Shopping

Using a Verified Klarna Account makes online shopping safer and easier. These accounts confirm your identity with Klarna’s system. This adds a layer of trust between you and the store. You can shop confidently, knowing your payments and information are secure.

What Makes A Klarna Account Verified?

A verified Klarna account means Klarna has checked your identity. This process includes:

- Confirming your personal details

- Verifying your payment methods

- Checking your credit or payment history

Verification helps Klarna prevent fraud and keep your account safe. It also enables access to more Klarna features during checkout.

Benefits Of Using Verified Klarna Accounts For Shopping

Shopping with a verified account offers several advantages:

| Benefit | Explanation |

|---|---|

| Faster Checkout | Your payment details are saved securely for quick purchases. |

| Buy Now, Pay Later | Access flexible payment options with less risk. |

| Improved Security | Reduced chances of fraud and unauthorized purchases. |

| Better Customer Support | Easier issue resolution due to verified identity. |

How To Use A Verified Klarna Account During Checkout

- Choose Klarna as your payment method.

- Log in with your verified Klarna account details.

- Select your preferred payment plan (pay now, pay later, or installments).

- Confirm your purchase.

Klarna will automatically apply the verification status. This makes the process quick and smooth.

Tips For Keeping Your Verified Account Safe

- Use a strong, unique password.

- Enable two-factor authentication if available.

- Regularly check your account for suspicious activity.

- Update your personal information promptly.

Klarna’s Fraud Prevention Measures

Verified Klarna accounts offer a safer way to shop online. Klarna uses strong fraud prevention measures to protect users and merchants. These measures help stop fake accounts and unauthorized purchases. The system checks every transaction carefully to keep your money and data safe.

Klarna’s Identity Verification Process

Klarna verifies each user’s identity before approving an account. This step confirms personal details like name, address, and date of birth. The process helps to:

- Prevent fake or stolen identities

- Reduce fraud risk

- Ensure only real users get accounts

This verification is quick and secure, using encrypted data checks.

Real-time Transaction Monitoring

Klarna monitors transactions as they happen. It looks for unusual activity, such as:

- Multiple purchases from different locations in a short time

- Large or unusual payment amounts

- Repeated failed payment attempts

When suspicious activity appears, Klarna may pause the purchase and ask for more verification.

Advanced Machine Learning Algorithms

Klarna uses smart algorithms to detect fraud patterns. These systems learn from past fraud cases to spot new threats. Benefits include:

- Faster detection of fake accounts

- Improved accuracy in identifying fraud

- Reduced false alarms for real users

The algorithms update constantly to stay ahead of fraudsters.

Secure Payment Authorization

Every payment through Klarna requires strong authorization. This step uses multiple layers of security, such as:

| Security Layer | Description |

|---|---|

| Two-Factor Authentication | User confirms identity with a code sent to their phone or email. |

| Device Recognition | Klarna checks if the device is trusted before approving payments. |

| Encryption | All payment data is encrypted to prevent hacking. |

Customer Education And Support

Klarna educates users on safe shopping habits. It offers tips like:

- Use strong, unique passwords

- Avoid public Wi-Fi for purchases

- Review account activity regularly

Customer support is ready to help if users spot suspicious actions.

Impact On Payment Flexibility

Verified Klarna accounts bring important changes to payment flexibility. They offer users more control and options for managing purchases. Verification helps Klarna provide safer and smoother payment plans. This means users can enjoy more freedom in how they pay for items.

What Does Verification Mean For Payment Options?

Verification confirms your identity with Klarna. It allows access to a wider range of payment methods. These include:

- Pay in 4 installments without interest

- Pay later options, usually within 30 days

- Longer-term financing plans with monthly payments

Verified users get clearer information about available options. Klarna can better tailor payment plans based on verified data.

Benefits Of Payment Flexibility With Verified Accounts

Payment flexibility helps manage your budget easily. Some key benefits include:

- More time to pay: Spread costs over weeks or months.

- Lower financial stress: Avoid large upfront payments.

- Faster approvals: Verification speeds up the checkout process.

- Improved security: Verified identity reduces fraud risk.

Comparison: Verified Vs Unverified Klarna Accounts

| Feature | Verified Account | Unverified Account |

|---|---|---|

| Payment Plans | Multiple flexible options | Limited or no options |

| Checkout Speed | Faster approvals | Slower or manual checks |

| Security | Enhanced protection | Basic security |

| Credit Limits | Higher limits possible | Lower or no limits |

Klarna Account Verification Vs Other Services

Verified Klarna Accounts offer users a safer and smoother shopping experience. Account verification proves your identity and protects your information. Comparing Klarna’s verification process with other services helps understand its strengths and differences. This section breaks down how Klarna verification stands apart.

Klarna Verification Process

Klarna uses a simple, secure process to verify users. It checks personal details like your name, address, and date of birth. Klarna also confirms your identity with documents or phone verification. The process is quick, often completed within minutes. This ensures only real users access Klarna’s services.

Verification Methods Of Other Services

Other payment services may require more steps or different checks. Some ask for multiple documents, like utility bills or bank statements. Others use third-party services for identity checks. These methods can take longer and might feel complex. Some services also use less secure email or phone checks.

Comparison Table: Klarna Vs Other Verification Services

| Feature | Klarna | Other Services |

|---|---|---|

| Verification Speed | Minutes | Hours to days |

| Verification Method | Documents, phone check | Multiple documents, third-party checks |

| User Experience | Simple and fast | Often complex |

| Security Level | High | Varies by provider |

Benefits Of Klarna Account Verification

- Faster access to payment options.

- Reduced fraud risk by confirming identity.

- Smooth checkout with less hassle.

- Trustworthy platform for users and sellers.

Challenges In Other Verification Services

- Long wait times for approval.

- Request for many documents.

- Confusing steps for users.

- Lower security in some cases.

Tips To Maintain Verification Status

Keeping your Verified Klarna Account active is important for smooth shopping and payment experiences. Maintaining your verification status helps avoid interruptions or delays. Follow simple steps to keep your account verified and enjoy Klarna’s full benefits without hassle.

Keep Your Personal Information Updated

Always provide accurate and current information. This includes your:

- Full name

- Address

- Phone number

Incorrect details may lead to verification issues or account suspension. Check your profile regularly and update any changes immediately.

Use Klarna Responsibly

Maintain a good payment history. Pay your bills on time and avoid exceeding your credit limit. This shows Klarna that you are trustworthy and reduces the risk of losing verification status.

Secure Your Account

Protect your account with a strong password. Change it periodically and do not share it with others. Enable two-factor authentication if available. This prevents unauthorized access and keeps your account safe.

Verify Identity Documents Promptly

Klarna may ask for identity proof to confirm your account. Submit requested documents quickly and in the correct format. Delays or incomplete submissions can cause verification problems.

Monitor Account Activity

Regularly check your account for unusual actions. Report suspicious activity immediately to Klarna support. Early detection prevents potential issues and keeps your verification intact.

| Tip | Why It Matters |

|---|---|

| Keep Information Updated | Ensures Klarna can verify your identity without delays |

| Use Klarna Responsibly | Maintains your good credit standing and trust |

| Secure Your Account | Prevents unauthorized access and misuse |

| Verify Documents Promptly | Avoids verification interruptions |

| Monitor Account Activity | Detects fraud early and protects your verification |

How To Update Verification Information

Keeping your Verified Klarna Account information accurate is key for smooth transactions. Updating your verification details helps avoid payment delays and security issues. This section explains simple steps to update your Klarna verification information quickly.

Updating Your Personal Information

Start by logging into your Klarna account on the official website or app. Navigate to the Profile or Account Settings section. Here, you can update:

- Full name

- Date of birth

- Address

- Phone number

Make sure all details match your official documents to prevent verification problems.

Changing Your Identification Documents

Klarna may request new ID documents for verification. Follow these steps:

- Go to the Verification tab in your account.

- Upload clear photos or scans of your updated ID, such as passport or driver’s license.

- Submit the documents for review.

Wait for Klarna to confirm the updates. This usually takes a few hours to a day.

Updating Payment And Bank Details

Correct payment information keeps your account active. To update:

| Step | Action |

|---|---|

| 1 | Access the Payment Methods section. |

| 2 | Add new bank or card details. |

| 3 | Remove old or expired payment methods. |

| 4 | Save changes to update your account. |

Verifying Email And Phone Number

Email and phone verification keep your account secure. To update them:

- Go to Contact Information.

- Enter your new email or phone number.

- Confirm via the code Klarna sends you.

This step ensures you receive all notifications and alerts.

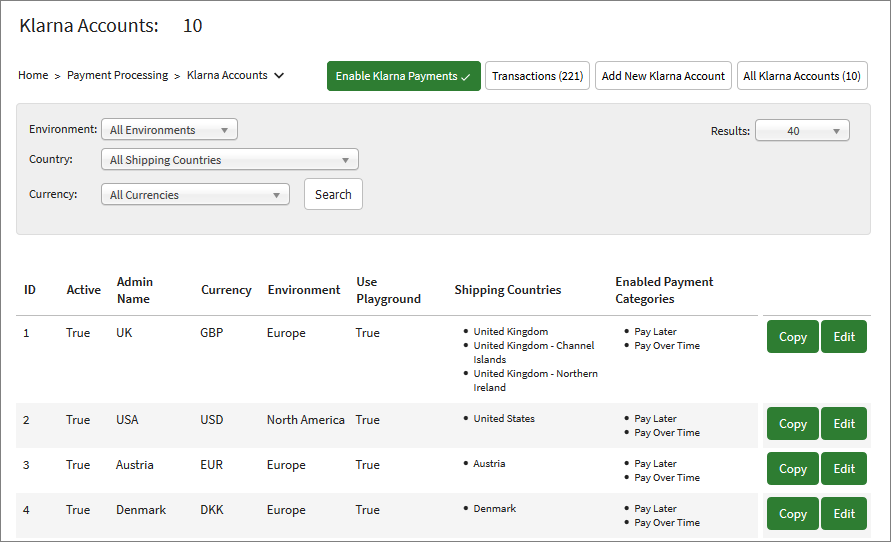

Credit: www.irpcommerce.com

Customer Support For Verification Issues

Verifying a Klarna account is important for smooth payments and security. Sometimes, users face issues during verification. Klarna offers strong customer support to solve these problems quickly. Getting help is simple and fast.

Contacting Klarna Support For Verification Help

Reach Klarna support easily through these methods:

- Phone: Call Klarna’s help center for direct assistance.

- Email: Send details about your issue and get a response within 24 hours.

- Live Chat: Use the chat feature on Klarna’s website for instant answers.

- Mobile App: Access support inside the Klarna app for quick help.

Common Verification Issues And Solutions

| Issue | Possible Cause | Quick Solution |

|---|---|---|

| Verification code not received | Wrong phone number or network delay | Check your number and request a new code |

| Document upload error | File too large or wrong format | Use clear photos in JPG or PNG format |

| Account locked after multiple tries | Too many failed attempts | Wait 24 hours or contact support directly |

Tips For Faster Verification Support

- Keep your personal and payment details ready before contacting support.

- Explain your problem clearly and provide screenshots if possible.

- Be patient and polite; it helps support agents assist you better.

- Use official Klarna channels only to avoid scams.

Legal And Privacy Considerations

Using a Verified Klarna Account involves handling personal information and financial data. Understanding the legal and privacy rules helps protect your data and keeps transactions safe. Klarna follows strict laws to secure your information and ensure fair use.

Legal Requirements For Verified Klarna Accounts

Klarna must follow financial laws in each country it operates. These laws include:

- Identity Verification: Confirming user identity to prevent fraud.

- Anti-Money Laundering (AML): Monitoring transactions to stop illegal money activities.

- Consumer Protection: Ensuring clear terms and fair treatment for users.

Users must provide accurate information to meet these legal needs. False information can lead to account suspension or legal action.

Privacy Policies And Data Protection

Klarna collects data to improve service and security. This data includes:

- Name and contact details

- Payment history

- Device and location information

Klarna uses advanced security methods to protect this data from theft or misuse. User data is only shared with trusted partners under strict agreements.

User Rights And Control Over Data

Users have rights over their personal information stored by Klarna:

- Access: Request a copy of personal data.

- Correction: Fix incorrect or outdated details.

- Deletion: Ask for data removal when no longer needed.

- Restriction: Limit how Klarna uses the data.

- Objection: Stop data processing for marketing.

These rights comply with laws like GDPR and give users control over their privacy.

Risks Of Sharing Account Information

Sharing account details with others can cause problems:

- Unauthorized purchases

- Identity theft

- Account suspension

Keep login details private and use strong passwords. Enable two-factor authentication for extra security.

| Legal Aspect | What It Means | User Action |

|---|---|---|

| Identity Verification | Confirm your identity to prevent fraud | Provide accurate personal information |

| Data Protection | Your data is stored securely and shared carefully | Review privacy settings regularly |

| Consumer Rights | You control your data and how it is used | Use your rights to access or delete data |

Future Of Verified Klarna Accounts

The future of Verified Klarna Accounts looks promising as more people seek safe and easy payment options online. Verified accounts give users trust and protect them from fraud. Klarna is improving its verification process to make shopping smoother and more secure.

Enhanced Security Measures

Klarna will use stronger security checks to keep accounts safe. These may include:

- Biometric verification such as fingerprints or face scans

- Real-time fraud detection systems

- Multi-factor authentication steps

These measures help stop unauthorized use quickly. Users will feel safer using Klarna.

Faster Verification Process

Klarna aims to make the verification process quicker. A faster process means:

- Less waiting time for account approval

- Smoother checkout experience

- Instant access to Klarna services

Speed matters. Quick verification keeps customers happy and reduces drop-offs.

Integration With More Services

Verified Klarna Accounts will link with other financial apps and services. This includes:

| Service Type | Benefit |

|---|---|

| Bank apps | Easy money transfers and account checks |

| Shopping platforms | Seamless payment options at checkout |

| Credit monitoring tools | Better control over spending and credit score |

More connections mean more convenience. Users manage finances in one place.

Frequently Asked Questions

What Is A Verified Klarna Account?

A verified Klarna account means your identity is confirmed by Klarna. It helps secure your transactions and allows you to use their services smoothly.

How Do I Verify My Klarna Account?

You verify your Klarna account by providing personal details and documents. Klarna checks these to confirm your identity and approve your account.

Why Is Account Verification Important For Klarna Users?

Verification protects your account from fraud and misuse. It also ensures Klarna can offer you credit safely and legally.

Can I Use Klarna Without Account Verification?

Limited use is possible, but full features need verification. Verification lets you shop with Klarna’s payment options and get credit.

How Long Does Klarna Account Verification Take?

Verification usually takes a few minutes to a few hours. Some cases may need extra checks, which take longer.

What Documents Are Needed To Verify A Klarna Account?

Common documents include a valid ID, passport, or driver’s license. Proof of address may also be required.

Is It Safe To Share Personal Info With Klarna?

Yes, Klarna uses strong security to protect your data. Your information is kept private and only used for verification.

Can I Verify My Klarna Account Multiple Times?

Usually, you verify once, unless Klarna requests updates. Updates may happen if your information changes or for security reasons.

What Happens If My Klarna Account Verification Fails?

You may be asked to submit more documents or try again. Without verification, you might lose access to some Klarna services.

How Does Verified Status Affect Klarna Credit Limits?

Verification helps Klarna assess your creditworthiness accurately. Verified accounts often have higher or more flexible credit limits.

Conclusion

Verified Klarna accounts help you shop with more confidence and ease. They offer better security and smoother transactions. Many users find them useful for managing payments. Keeping your account verified keeps your shopping experience safe. Always follow Klarna’s rules to maintain your account status. This way, you avoid issues and delays. Verified accounts also help build trust with sellers. Start using a verified Klarna account for safer online payments today. Simple steps lead to better control and peace of mind.

Based on the USA.

Based on the USA.

Reviews

There are no reviews yet.