Buy Verified Remitly Account

Imagine a world where sending money to your loved ones across borders is as easy as sending a text message. With Remitly Accounts, this isn’t just a dream—it’s a reality. If you’re tired of complicated bank transfers, hidden fees, and long wait times, you’re in the right place. Remitly has revolutionized the way you can support your family and friends globally, all while keeping things simple and transparent. But what makes Remitly stand out in the crowded field of money transfer services?

Stay with us as we uncover how Remitly Accounts can change the way you think about sending money, bringing peace of mind and efficiency to your fingertips.

Remitly’s Journey

Remitly’s journey is a story of innovation and growth. With a vision to simplify global remittances, Remitly has transformed the way people send money. It offers a fast, secure, and affordable service. Let’s explore Remitly’s path to success.

Founding Story

Remitly Accounts began in 2011 with an ambitious idea. Matt Oppenheimer, the founder, wanted to change the remittance industry. He saw how difficult it was for immigrants to send money home. This challenge inspired him. With co-founders Josh Hug and Shivaas Gulati, Remitly was born. Their goal? Make money transfers easier and more accessible.

Growth And Expansion

Remitly Accounts started small but grew quickly. It expanded its services to many countries. The company focused on customer needs and security. This focus led to a loyal user base. Remitly now serves millions of customers worldwide. It continues to innovate and improve its platform. This growth shows its commitment to global financial inclusion.

Innovative Technologies

Remitly Accounts stands out with its innovative technologies in money transfer. These technologies streamline processes, ensuring fast and secure transactions. The platform combines digital solutions with top-notch security. This makes it a leader in global remittance services.

Digital Platforms

Remitly Accounts uses advanced digital platforms. These platforms offer ease and efficiency. Users can send money with just a few clicks. The interface is user-friendly. It caters to tech-savvy users and those new to digital transactions. Mobile applications enhance accessibility. They allow transactions from anywhere, anytime. This digital approach reduces traditional banking hassles. It offers a modern solution for sending money globally.

Security Measures

Security is a top priority for Remitly. The platform uses encryption to protect user data. It ensures transactions are safe from cyber threats. Two-factor authentication adds an extra layer of security. This method verifies user identities, preventing unauthorized access. Regular audits maintain high security standards. They ensure compliance with global financial regulations. Remitly’s commitment to security builds trust among users worldwide.

User Experience

When using Remitly to send money internationally, your experience as a user is paramount. How seamless is the process? How responsive is the support? Your journey with Remitly should be straightforward, and knowing what to expect can make all the difference. Let’s dive into what makes Remitly’s user experience stand out.

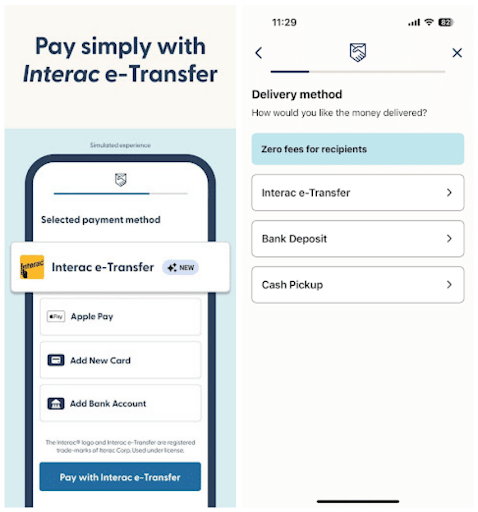

Ease Of Use

Imagine you’re trying to send money to a family member overseas. You don’t want to spend hours figuring out complicated processes. Remitly shines in making this task simple. The interface is intuitive, guiding you step-by-step through the transaction process.

Everything is laid out clearly. You can easily select the recipient’s country, enter the amount, and choose the delivery method. It’s as if Remitly Account anticipates your needs, making the entire process feel like a breeze.

You’re not left wondering what to do next. The platform’s design ensures that you have all the information you need at your fingertips. Have you ever felt frustrated navigating a complicated app? With Remitly, that’s a worry of the past.

Customer Support

What happens if you face an issue during your transaction? With Remitly Account, you’re not alone. Their customer support is designed to be responsive and helpful, ensuring you’re supported every step of the way.

Have you ever tried contacting a service provider only to wait endlessly for a response? Remitly prioritizes your queries. Their team is available to assist, whether through chat, email, or phone, providing timely solutions to your concerns.

Knowing you can reach out and get help quickly can be reassuring. It gives you confidence in using their service, knowing that you’re valued and heard. Have you had positive experiences with customer support? Share them below and let’s see how Remitly compares.

Competitive Edge

Remitly Accounts provides fast, secure money transfers, helping users save time and effort. Its user-friendly platform ensures accessibility for everyone. Competitive rates make it an attractive choice for global remittances.

In the bustling world of digital remittances, what makes Remitly stand out? The company has carved a niche by offering more than just a platform for sending money. Remitly’s competitive edge lies in its strategic market positioning and innovative pricing strategies, which cater to an ever-evolving customer base. Understanding these strengths can help you make informed decisions about your own financial transactions.

Market Position

Remitly Accounts has secured a strong foothold in the international money transfer market. It focuses on providing seamless, fast, and reliable services to its users. Unlike traditional banks, Remitly offers a user-friendly app that simplifies the remittance process. Many customers appreciate the convenience of transferring funds directly from their smartphones. Moreover, Remitly targets underserved markets, offering services in regions where traditional banking options are limited. This strategic approach helps the company build a loyal customer base. If you’ve ever struggled with complicated transfer processes, you’ll find Remitly’s services refreshingly simple.

Pricing Strategies

How does Remitly Accounts keep its pricing competitive without compromising on quality? The company employs a dynamic pricing model that adjusts fees based on the speed of delivery. If you need funds transferred instantly, Remitly offers an express service at a premium rate. Alternatively, their economy option provides a more cost-effective solution for non-urgent transfers. Remitly’s transparent pricing structure ensures you’re never caught off guard by hidden fees. This clarity builds trust and encourages repeat business. If you’re looking for a service that respects your budget and time, Remitly’s pricing strategies are designed with you in mind. By focusing on market position and pricing strategies, Remitly continues to offer valuable services to its users. What aspects of Remitly’s approach resonate most with you? Whether it’s their market reach or cost transparency, understanding these facets can help you choose the best option for your money transfer needs.

Global Impact

Remitly Accounts has a significant global impact. It helps people send money across borders easily. This service supports families and communities worldwide. Let’s explore how Remitly Account contributes to economic empowerment and community development.

Economic Empowerment

Remitly Accounts plays a key role in economic empowerment. It provides a safe way to send money home. This allows families to meet daily needs without hassle. Remitly’s affordable rates mean more money reaches loved ones. People can invest in education, healthcare, and housing. This boosts the overall financial health of communities.

Community Development

Remitly Accounts supports community development in many countries. Remittances help fund community projects. These projects can include building schools and hospitals. Improved infrastructure leads to better living standards. Money sent through Remitly often supports local businesses. This creates jobs and strengthens local economies.

Future Prospects

Remitly Accounts stands as a key player in the money transfer industry. Its future prospects are promising, driven by its strategic focus and innovation. With the world becoming more interconnected, Remitly adapts to meet changing needs.

Emerging Markets

Emerging markets offer vast opportunities for Remitly’s growth. Many countries are developing rapidly, increasing their demand for reliable money transfer services. Remitly Account taps into these markets, providing accessible financial solutions. Its presence in emerging economies boosts user confidence and expands its customer base. This positions Remitly Account favorably for future expansion.

Technological Advancements

Technology drives Remitly’s future prospects. Digital solutions enhance security and speed, meeting customer expectations. The integration of AI and blockchain could redefine services. These advancements promise more efficient and cost-effective transactions. Remitly Account embraces technology, ensuring seamless experiences for users. This commitment solidifies its place in the evolving global landscape.

Frequently Asked Questions

What Is Remitly Used For?

Remitly Accounts is a digital financial service that allows users to send money internationally. It offers fast, reliable, and affordable money transfers. Users can send funds to family and friends in over 50 countries. The service emphasizes security and ease of use for both senders and recipients.

How Does Remitly Ensure Security?

Remitly Accounts ensures security by using industry-standard encryption and privacy measures. It is regulated by financial authorities in the countries it operates. Remitly Account also monitors transactions for any suspicious activity. This ensures that users’ information and funds are always protected and secure.

How Long Do Remitly Transfers Take?

Remitly Accounts offers different delivery speeds depending on the service chosen. Express transfers typically arrive within minutes. Economy transfers usually take three to five business days. The delivery time may vary based on the recipient’s location and the chosen payment method.

What Are Remitly’s Transfer Fees?

Remitly’s transfer fees vary depending on the sending and receiving countries. Fees are influenced by the transfer speed selected. Express transfers typically have higher fees than Economy transfers. Remitly Accounts provides a clear fee breakdown before confirming any transaction, ensuring transparency for users.

Conclusion

Remitly Accounts simplifies sending money globally. Its platform is user-friendly and reliable. With its secure service, users can transfer funds quickly. Remitly Account offers competitive rates, making it affordable for everyone. People trust Remitly for its transparency and ease of use. It’s a great choice for those who need to send money abroad.

The service caters to diverse needs, ensuring satisfaction. Remitly proves its worth with seamless transactions. Every transfer becomes hassle-free and efficient. Users gain peace of mind knowing their money is safe. Choosing Remitly means choosing convenience and confidence. A smart way to send money worldwide.

Julian Gomez – –

Best place to buy a Remitly Account, no hassles, no delays. Worked perfectly from day one!